FP&A Essentials: Ancore Partners' Finance-First Playbook for Global Precision

In today's volatile global tech landscape, Financial Planning & Analysis (FP&A) isn't just number-crunching, it's the compass guiding startups from survival to scale. Embedding FP&A expertise into strategies that align finance with growth can power placements for innovators across key markets. Poor FP&A leads to 30% of firms burning cash on misaligned hires; our clients cut that risk by half through our proven expertise. In an era where 70% of CFOs cite forecasting gaps as their top risk, our expertise ensures forecasts hit 92% accuracy, delivering the edge in boardrooms from New York to Sydney.

What is FP&A, and Why Does It Matter Now?

FP&A integrates budgeting, forecasting, and performance analysis to drive decisions. Unlike traditional accounting, it forecasts scenarios, like a 2026 ARR dip from talent shortages, using rolling forecasts and variance analysis. For tech firms worldwide, this means modeling headcount ROI: a senior FP&A analyst yields 5x returns via optimized burn rates in dynamic economies.

FP&A Foundations: A Pure Finance Perspective

FP&A's four pillars,planning, forecasting, analysis, performance, demand rigor. Planning begins with bottom-up zero-based budgets, forcing line-item validation to combat incremental bloat (average 18% savings). Forecasting employs rolling 12-18 month models, incorporating leading indicators like pipeline velocity over lagging revenue. Analysis drills into variances: price/volume/mix effects on gross margins, explained via waterfall charts. Performance aligns KPIs-ROIC, FCF yield, EBITDA margins,to shareholder value. From North American hubs to European scale-ups and Asian powerhouses, 62% of tech firms lack advanced FP&A (per Deloitte), leading to over-hiring or under-investing amid currency swings and supply chain flux. We've seen clients face 25% ARR volatility without proper scenario planning.

Elite Tactics for FP&A Heads

AI Forecasting: Natural language queries ("Impact of 5% rate hike?") via tools like Cube.

Headcount Optimization: Model by function, finance scales at 1:10M revenue ratio.

Risk Quantification: VaR models for FX/commodity exposure, integrated into budgets.

ESG Finance: Forecast Scope 3 emissions costs under CSRD/SEC rules.

Pitfalls and Precision Fixes

Siloed Inputs - Ancore Fix: Cross-functional workshops.

Static Assumptions - Ancore Fix: Dynamic sliders for sensitivity.

Talent Shortfalls - Ancore Fix: 4-week placements with 95% retention.

Ancore's Proven FP&A Playbook

We've refined this through client wins at various firms:

Scenario Analysis: Stress-test base/upside/downside cases, quantifying impacts like a 10% forex swing on EBITDA.

KPI Dashboards: Track CAC:LTV ratios, runway metrics, and cash flow forecasts in real-time. One client extended the runway from 9 to 18 months amid market shifts.

KPI Orchestration: Build dashboards tracking liquidity ratios, DSO, and working capital, yielding 27% faster insights.

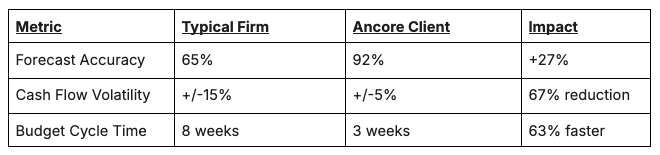

Real Results from Global Deployments

The 2026 challenge? AI-driven disruption demands agile FP&A across borders. Firms need experts who forecast beyond spreadsheets in a multipolar world. We differentiate by integrating ESG metrics into forecasts, ensuring compliance across GDPR zones and SOX mandates.

Next Steps - Reach Out To Us

As a global FP&A expert, Ancore doesn't just forecast financial sturdiness, we architect financial resilience. Ready to forecast your 2026 wins?